EDUCATION LOAN:

Nothing can replace quality education when it comes to building a bright and successful future for your child and education is the only thing that can get a happy life going. However, due to the rising cost of higher education for students in India as well as abroad, parents are finding it more and more difficult to self-finance their children’s education hence there is a huge demand for loans to cover education expenses. Unlike most educational institutions today, educationalloans are given to meritorious and deserving students so that nothing hinders their progress and they achieve the best of education in India or abroad. At present, almost every Indian bank and NBFC offer education loans in India to students interested in pursuing a wide range of graduate, post graduate, professional and doctoral courses/degrees.

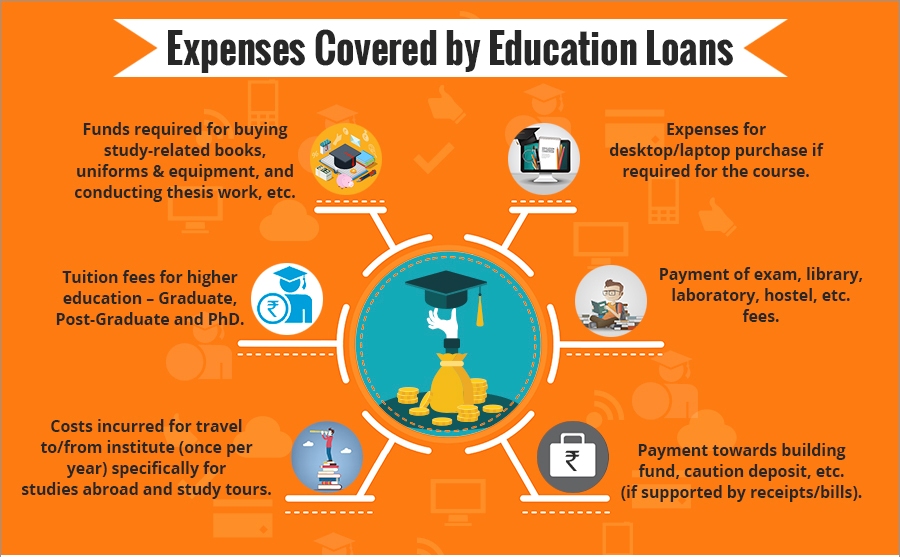

The quantum of expenses covered by this type of loan covers not just the direct expenses such as tuition fees and registration/examination fees, but also allied expenses such as those for uniforms, lab equipment/tools required for the course, travelling expenses and laptop. Aside from the fee payable to the school/college, other expenses covered by most education loans include:

- Amount required towards the purchase of books, uniforms, equipment and instruments.

- Purchase of computers/laptops, if deemed necessary for the completion of the course.

- Fees paid for Exams, Library, Laboratories, Hostel, etc.

- Building fund, Caution deposit, Refundable deposit (must be supported by receipts/bills).

- Costs incurred in travel, specifically for studies abroad.

- Additional costs that are required to successfully complete the course, including but not limited to, Study tours, Thesis work, Projects, etc.

AnEducation loanplan is a safe and efficient way to gain finance for when compromising on your child’s education is not an option. It is a long-term investment in your child’s secure future. It has the following features:

- Anyone can opt for Education loan to study abroador in India for graduate, post graduate, professional and/or doctoral courses/degrees.

- Loan cannot be assigned to the student alone, the parent or guardian needs to be co-signor for the loan.

- Female students are usually offered discounts and/or lower interest rates when it comes to education loans.

- The annual family income and the course pursued by the education loan applicant are primary determinants of the loan amount.

- Generally, loans below Rs.4 lakhs do not require a security or guarantor.

- For an education loan plan up to a specific amount, no collateral is necessary for a higher loan amount (usually above 7.5 Lakhs), security in the form of fixed deposit, property or other bank approved collateral is required.

- Usually, the maximum loan limit for students studying in India is capped to Rs.10 – 15 lakh and up to20 lakh for those who wish to study abroad with an Educational loan.

- The normal student loan repayment period is 5 to 7 years, but flexible options for settlement of education loanswith longer time period, i.e. 10to15 years is also available.

- One can get aneducational loanat the time of study, but that educational loandoes not need to be serviced during the course time period and also features a moratorium period of up to 1 year or till the borrower gets regular employment, whichever is earlier.

There are numerous advantages of education loansover a personal loan. Loans for Education are versatile and offer the following benefits-

- With the recent inflation and shifting prices, you cannot be fully certain about money saving. An all-encompassing education loan liberates you from the constant worry of accumulating sufficient money to fund your child’s higher education. In today’s time, agood education is expensive and these expenses have been increasing continuously.A good education loan keeps you safe from any unexpected costs that can obstruct your child’s future dreams.

- There are many expenses that incur throughout a course apart from just studies- library fees, building deposits, laboratory fees, caution deposits, books, uniform, travel etc. All the aspects relating to the course can be covered with a comprehensive education loan without ever running out of money.

- They have been popular recently and one can easily avail education loan for studying overseas. RBI lists these loans as a part of the priority sector and so do banks. Conforming to some basic requirements and confirming your ability to repay the borrowed amount is all it takes to get on-board.

Under education loans from any particular financial institution in India, the following courses are applicable for students who wish to study in the country: Graduation, Post-Graduation, Diploma programs, Technical courses, Management courses and other professional courses. Whereas, courses applicable for students who wish to study abroad include the following: Graduation, Post-Graduation, Certificate Degree courses from CIMA- London, CPA-USA and other such well known educational entities.

Any of the following courses, as offered by recognized universities, is eligible for education loans in India-

- Professional courses including Engineering and Medicine

- Management courses (both full time and part time)

- ICWA, CA, CFA etc.

- Courses conducted by IIMs, IITs, IISc, XLRI. NIFT,NID etc.

- B.A/B.Com/M.A/M.Com/MCA/MCM etc.

- Architecture, Agriculture studies, Fine Arts and Designing etc.

- Hotel and Hospitality

- Courses such as SAP, ERP, GNIIT, Air Hostess Training programs etc.

- Distance learning programs and online certifications.

- Degree/Diploma courses like Aeronautical, pilot training, shipping, etc.,

- Aircraft Maintenance Engg., Pre-Sea Training courses and the like.

- Nursing and Para Medical courses (includes admission via management quota).

- Courses offered by reputed institutes that assure employment and are Govt. certified.

- Courses offered in India by reputed and certified foreign universities.

- All courses listed on these websites-

The education loan eligibility differs from provider to provider. However, the basic criteria are as follows:

- You should be an Indian citizen

- If the applicant is a Non-Resident Indian (NRI), he/she must hold a valid Indian Passport

- You should fall in the age bracket defined by the respective bank

- You need to have a confirmed admission offer from a recognized college/institution (banks usually have a list of institution that they update from time to time)

- You need to apply for an education loan with a co-applicant who has a regular source of income

- A good academic record and good credit history of the co-borrower (parent or guardian) helps with quick education loan approvals.

Some banks require the applicant to have qualified through a national level entrance exam.

Loan Guarantor

Taking up an education loan requires a co-applicant which can be the applicant’s parent, spouse, siblings or in-laws. For loans of amounts up to Rs.4 lakh, most banks do not ask for any guarantor or security. However, some banks may ask for some kind of security such as gold, shares, fixed deposits, LIC policies and real estate other investments etc. Moreover, some banks might ask for a third party guarantee from someone who’s not in blood relation. These guarantors may include one’s uncle, father’s friend or any of the relatives can make this third party guarantee, first being the applicant and second being the co-applicant of the borrowed loan. This is to ensure if the first/second guaranteed person is unable to pay then the third party person have to bear the loan.

The following table applies for most educational or student loans offered by various banks and financial institutions.

| For loans up to 4 lakhs | Co-obligation of parents is required. |

| For loans above Rs.4 lakh and up to Rs7.5 lakh | Co-obligation of parents together with third party guarantee is required. |

| For loans above Rs.7.5 lakh | Co-obligation of parents together with tangible collateral security of suitable value. |

Along with a duly filled education loan application form of the lender bank/ institution and photographs, the applicant is required to submit the following documentation:

- Letter of admission confirmation received from the college/institution

- Fee breakdown, stating the tuition fees and other charges provided by the college/institution

- Copies of mark sheets starting from class 10th to the last qualifying exam cleared

- A declaration/affidavit to confirm no other loan has been availed for the same or another course

- Identity and signature proof [Passport, Pan Card, Driving License, Voter ID Card, Aadhar Card or the Employee identity Card in case of government employees]

- Address Proof [Bank statement, Rent Agreement, Voter ID Card, Ration Card, Passport, Driving License; telephone, electricity, or water bill;Credit Card Bill or Property Tax]

- Age Proof [Voter ID Card, Secondary School Certificate (class 10), Birth Certificate, Passport or Aadhaar Card]

- Income proof of co-borrower or the applicant if he/she is employed

- In case of a salaried individual [Latest salary slip with Form 16 or Salary account bank statement for the six months prior to applying for an education loan]

- Self-employed businessmen/professionals [Latest ITR, computation of income, Profit & Loss and Balance Sheet certified by a CA, Business continuity proof]

- Qualification proof of highest professional degree acquired.

Education Loan Interest Rates

The interest rates on Education Loans tend to vary from bank to bank. There are some standard factors that affect interest rates on like education loan tenure, the amount borrowed and the competitive market rates being an important factor. In case of education loan, girl students are eligible for an additional discount of 0.5% on the rate offered to male borrowers. Usually, the education loan interest rate is computed as a certain percentage usually, between 1.5-2.5% over base rate hence interest rate start from as low as 11.25%. However, in India, education loans usually charge floating interest rates ranging from 12.00% to 16.00% and repayment periods upto 10 years.